Index Option

Main Page

Credit Default Swap, Index and Index Option

Background

Options

:link: See Purgramming – Introduction to Options for more details for more details

Options are a form of derivative financial instrument in which two parties contractually agree to transact an asset at a specified price before a future date.

An option gives its owner the right to either buy or sell an asset at the exercise price but the owner is not obligated to exercise (buy or sell) the option.

:orange_book: When an option reaches its expiration date without being exercised, it is rendered useless with no value.

Options are used on

- Individual stocks

- Exchange-traded funds (ETFs)

- Currencies

- Stock market indexes

- Bonds

:orange_book: Option ≠ Obligation

Call / Put

Call

Call = Right to buy = Long

Price ↑ can earn profit

Price ↓ lose premium paid

Put

Put = Right to sell = Short

Price ↑ lose premium paid

Price ↓ can earn profit

CDS Index Option

A CDS index option (CIO) is an agreement between two parties giving the buyer the right, but not the obligation, to buy or sell credit protection on a specified CDS index at a specified price (strike price[1]) on a specified future date (expiry [2] date).

:green_book:

[1] Strike price: The price / spread at which you can buy (with a call) or sell (with a put) the underlying investment.

[2] Expiration: How long you have left to use the option after which it expires. For index option, it’s typically less than six months to expiry (Generally expiries which match CDS roll dates are most liquid)

Terminology

[1] Underlying Index: The investment that the option is on. If you buy a call option on Apple stock, Apple is the underlying. For index option, it’s typically the 5yr on-the-run index series.

[2] Notional: Fixed amount of index protection

[3] Premium: The up-front cost that the option buyer pays to the seller. (% of notional)

[4] Breakeven: Spread or price at which the P&L from exercising the option is equal to the premium paid

[5] Moneyness: If exercising an option today would earn a profit, it’s said to be “in the money.” Options that would earn a loss are “out of the money.”

Payer option

The right to buy credit protection

Receiver option

The right to sell credit protection

Settlement

Settlement type: T+3 settlement

A CIO can either be cash settled at expiry using a specified reference spread or reference price, or it can be physically settled at the strike price.

In case of cash settlement, the method determining the price of the reference spread at expiry must be specified at trade inception.

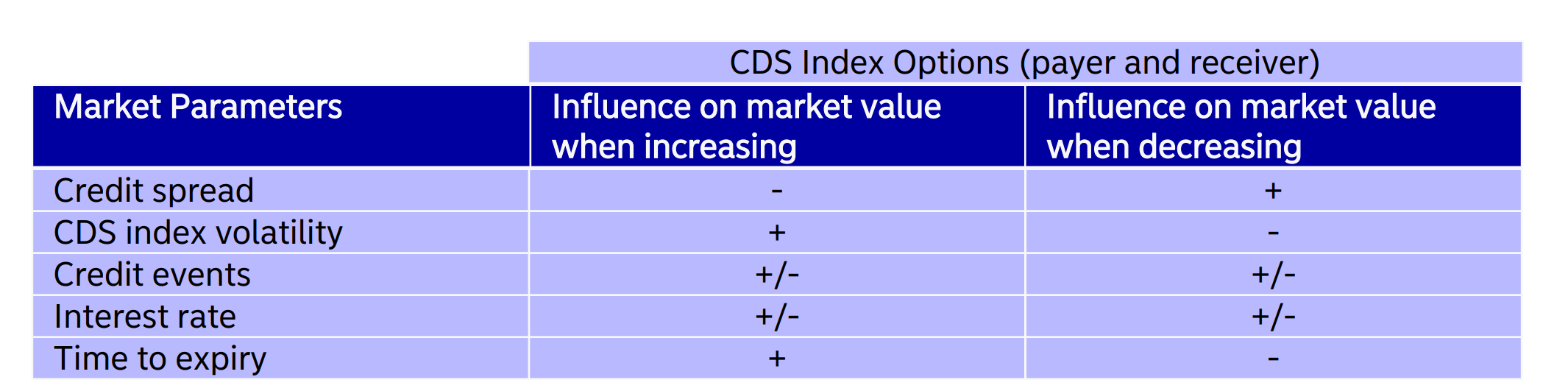

Market Parameters

The market value of a CIO is exposed to the market parameters listed in the matrix below.

Examples

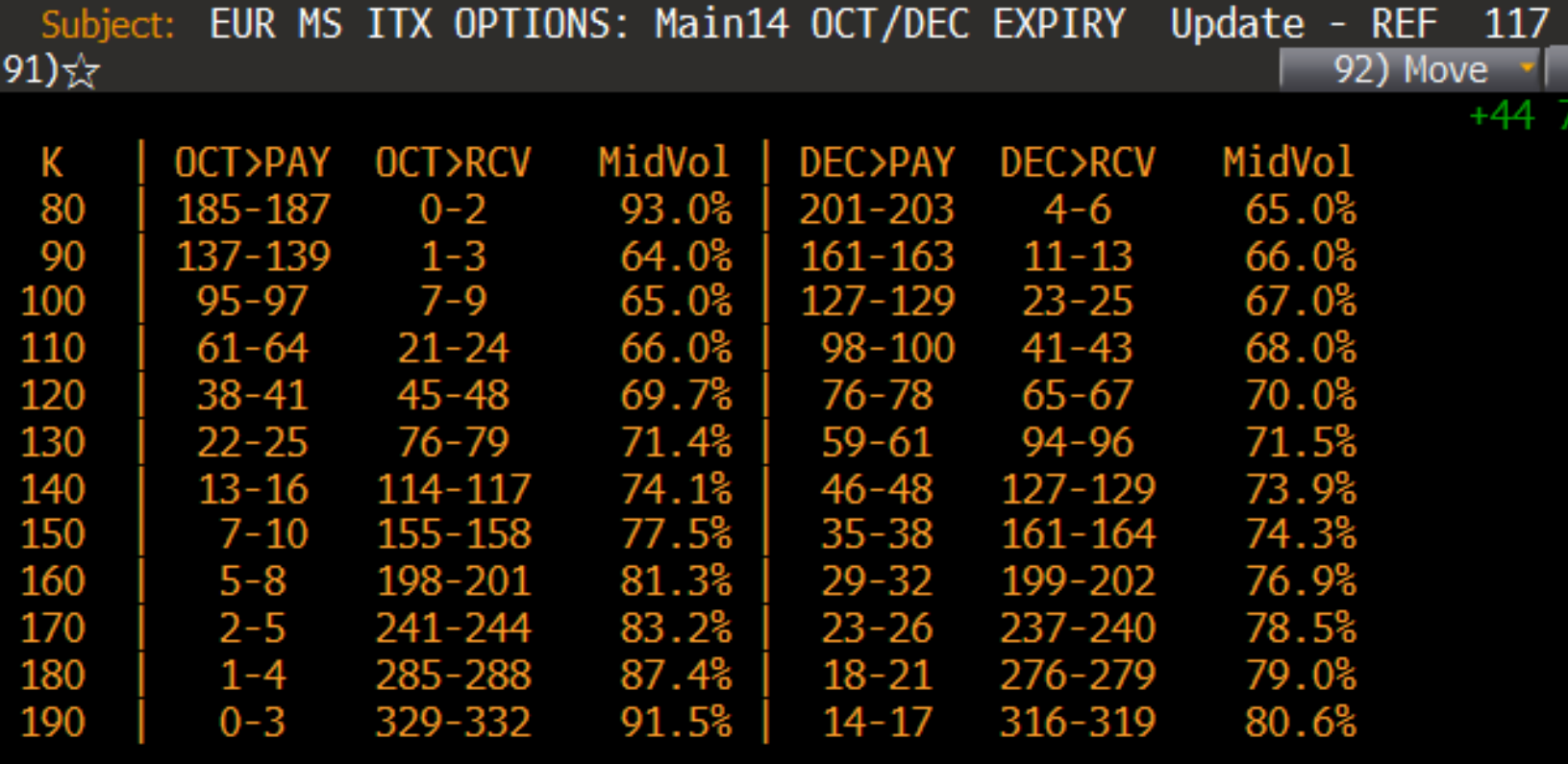

CDX IG – spread basis

Typical SPREAD Options Run (CDX IG)

Quoting

- Many indices (CDX IG, iTraxx Main) are quoted on a spread basis

- Strike levels on these options are quoted as a spread level

- Option prices are quoted in upfront basis points

Ref

Ref (at top of the run) is the current spot level of the index (in this case, iTraxx Main is at 117bps)

Volatility

Volatility is a statistical measure of the dispersion of returns for a given security or market index.

In most cases, the higher the volatility, the riskier the security.

- The volatility shown on these runs is spread volatility – a key distinction from equity or FX options

- Spread volatility has to be converted to a price volatility to make it comparable to equity volatility

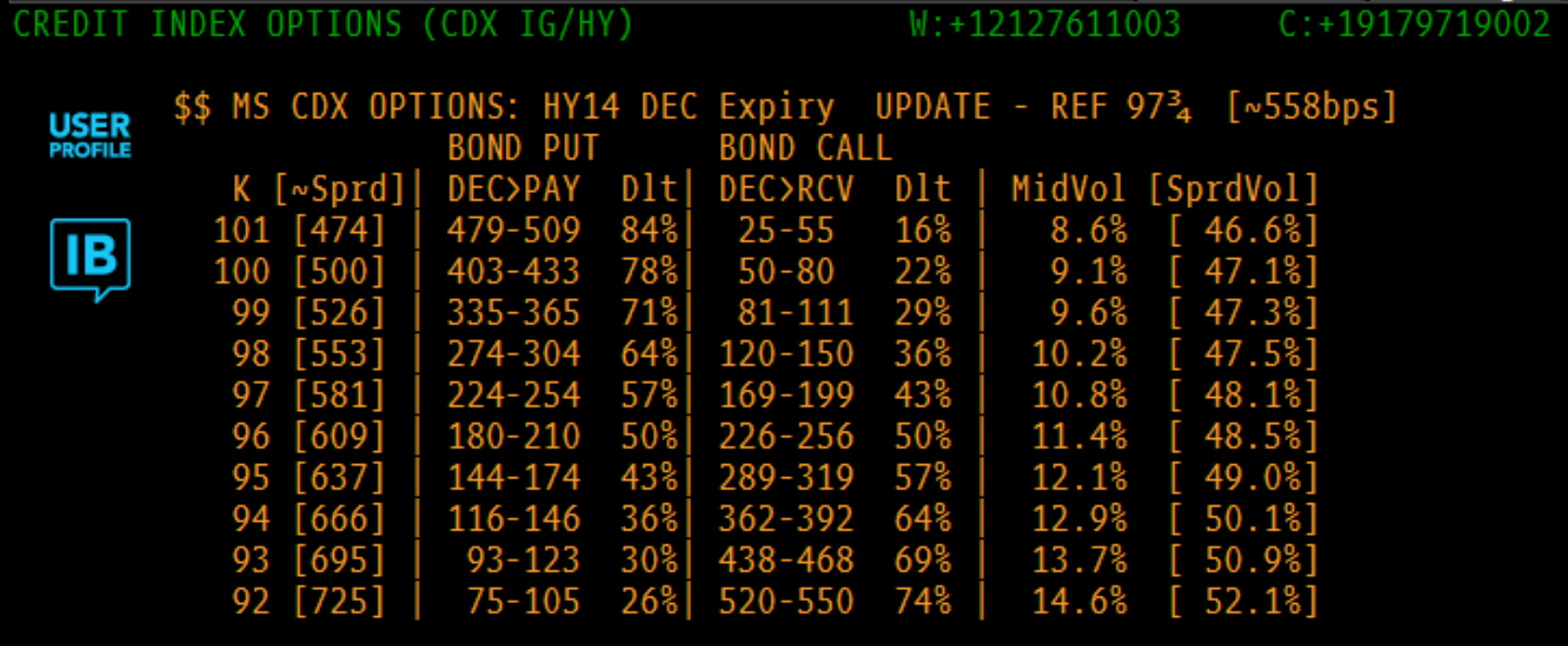

CDX HY – price basis

Quoting

- CDX HY index is quoted on a price basis

- Strike levels are quoted as a price level, typically with equivalent spreads

- Option prices are quoted in upfront basis points

Ref

The index ref is shown in both price (97.75 here) and spread (~558bps)

Volatility

The volatility quotes on these runs is generally price volatility, which is directly comparable to equity volatility

Reference

Major References

Global volatility summit.com. 2021. [online] Available at: https://www.globalvolatilitysummit.com/wp-content/uploads/2015/10/Credit-Derivatives-Strategy-Credit-Options-Overview-Morgan-Stanley-Research.pdf [Accessed 26 July 2021].

E-markets.nordea.com. 2021. [online] Available at: https://e-markets.nordea.com/DownloadDocumentService/api/DownloadDocument/UPI/INDEX_OPTION-TAC1_TM1/PRD_en_gb [Accessed 26 July 2021].

Other References

Mfe.baruch.cuny.edu. 2021. [online] Available at: https://mfe.baruch.cuny.edu/wp-content/uploads/2019/12/IRC_Lecture7_2019.pdf [Accessed 26 July 2021].

Globalcapital.com. 2021. Credit-Default Swap Index Options. [online] Available at: https://www.globalcapital.com/article/k64qvpznv8ld/credit-default-swap-index-options [Accessed 26 July 2021].

Globalcapital.com. 2021. An Introduction To Credit Options. [online] Available at: https://www.globalcapital.com/article/k65hqqgnystt/an-introduction-to-credit-options [Accessed 26 July 2021].

Uk.mathworks.com. 2021. Pricing a CDS Index Option- MATLAB & Simulink- MathWorks United Kingdom. [online] Available at: https://uk.mathworks.com/help/fininst/pricing-a-cds-index-option.html [Accessed 26 July 2021].

Napkin Finance. 2021. What is Options Trading? What Are Options? Napkin Finance has your answers!. [online] Available at: https://napkinfinance.com/napkin/finance-options/ [Accessed 26 July 2021].

https://stackedit.io/app#

https://www.globalvolatilitysummit.com/wp-content/uploads/2015/10/Credit-Derivatives-Strategy-Credit-Options-Overview-Morgan-Stanley-Research.pdf

https://chrome.google.com/webstore/detail/copy-all-urls/djdmadneanknadilpjiknlnanaolmbfk/related?hl=en

https://www.pimco.co.uk/en-gb/resources/education/understanding-credit-default-swaps/?r=Institutional%20Investor&l=United%20Kingdom&s=true&lang=en-gb

https://www.investopedia.com/terms/c/creditdefaultswap.asp

https://cdn.ihsmarkit.com/www/pdf/1221/CDS-Indices-Primer—2021.pdf

https://cdn.ihsmarkit.com/www/pdf/0621/CDS-BM-TR-ER-Indices-Benchmark-Statement.pdf

https://cdn.ihsmarkit.com/www/pdf/0919/383074646-0819-CW-FIN-Brochure-CDSPricing-HighRes.pdf

https://ihsmarkit.com/products/red-cds.html

https://cdn.ihsmarkit.com/www/pdf/Pricing-Data-Liquidity-Services.pdf

https://cdn.ihsmarkit.com/www/pdf/RED-CDS-Factsheet.pdf

https://cdn.ihsmarkit.com/www/pdf/Pricing-and-Reference-Data.pdf

https://cdn.ihsmarkit.com/www/pdf/0121/Sector-Curves.pdf

https://ihsmarkit.com/products/markit-itraxx.html

https://cdn.ihsmarkit.com/www/pdf/0720/CDS_factor_performance_update.pdf

https://ihsmarkit.com/products/single-name-pricing-data.html

https://ihsmarkit.com/products/indices.html

https://ihsmarkit.com/products/markit-cdx.html

https://en.wikipedia.org/wiki/Credit_default_swap_index

https://www.investopedia.com/terms/d/dowjonescdx.asp

https://bsic.it/credit-default-swaps-indices-curves-and-their-relationship-to-volatility/