Accrued Interest

Motivation

Accrued interest ensures a fair distribution of bond interest between buyers and sellers.

Background:

- The interest of a bond, also known as the coupon, is usually paid on fixed dates, which are typically specific dates each year, such as January 1 and July 1 of each year.

- The buying and selling of bonds in the secondary market can happen at any time, not just on the coupon dates.

Potential Issue:

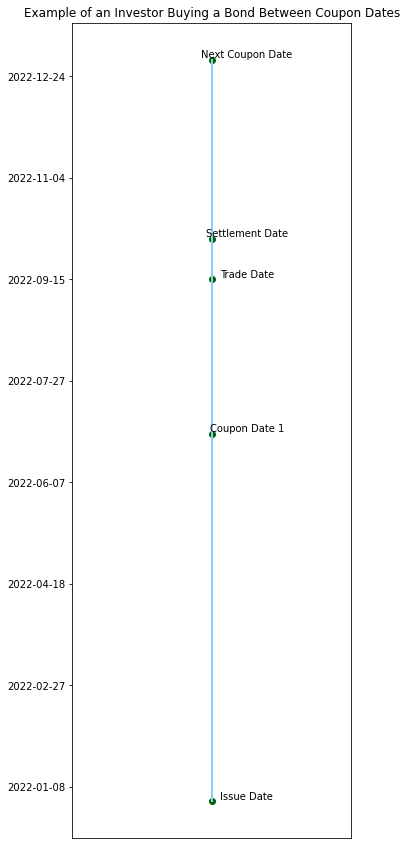

Suppose an investor buys a bond on a day between coupon dates. Then, on the next coupon payment day, they will receive the interest for the entire period. However, part of this interest has been accrued before they purchased the bond. This raises the question of who should receive this portion of the interest.

If interest distribution is only based on the coupon dates, the investor who bought the bond will receive the interest for the period they did not actually hold the bond, and the seller of the bond will miss the interest for the period they actually held the bond. This is obviously unfair.

Accrued Interest

Accrued interest is essentially the interest that an investor who buys a bond on a day between coupon dates has to pay to the seller, which corresponds to the period that the seller held the bond before selling it.

Key Dates in Bond Trading

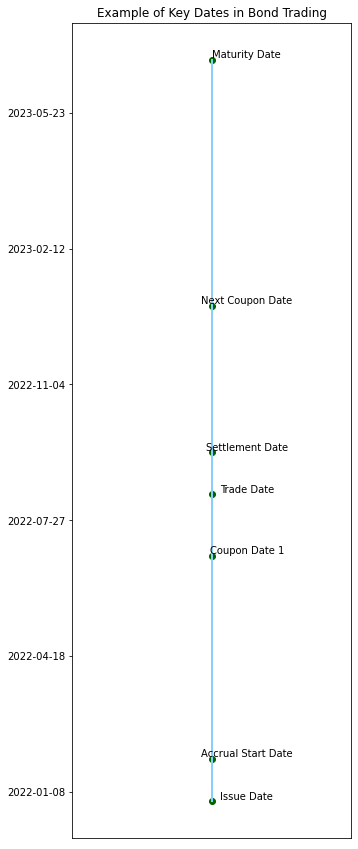

The various dates in a bond are usually in the following order of time:

- Issue Date: This is the date when the bond is first sold by the issuer to investors i.e. the issue date is when a new bond begins to circulate in the market.

- Accrual Start Date: This is the date when the bond starts to accrue interest. Usually, this would be the same as the issue date, but sometimes it can be a little later.

- Coupon Date: This is the date when the issuer pays interest to the holders. Usually, there are two coupon dates each year.

- Trade Date: This is the date when investors buy and sell the bond in the secondary market after the bond’s initial issuance. This date can be any day as long as the market is open.

- Settlement Date: This is the actual date of transfer of ownership of the bond, i.e., when the buyer pays the money and the seller delivers the bond. Usually, this date is one to two business days after the trade date.

- Next Coupon Date: This is the date when the issuer will pay the next interest. If the holder sells the bond before this date, they will not receive the interest payment for this date.

- Maturity Date: This is the date when the bond’s principal is due and needs to be paid back to the bondholders. On this date, in addition to the last interest payment, investors will also receive their principal.

Sequence

i.e. the usual order of time is: Issue Date -> Accrual Start Date -> Coupon Date -> Trade Date -> Settlement Date -> Next Coupon Date -> Maturity Date

Day Count Convention

Motivation

Ensuring accuracy, consistency, and transparency in the financial market, simplifying calculations, and adapting to different market needs.

Common Day Count Conventions

Day count convention is the way to calculate the difference between dates when calculating accrued interest. The two most common day count conventions are 30/360 and Actual/Actual.

30/360: This convention assumes that each month has 30 days and each year has 360 days. So, if the purchase date of the bond is January 1 and the next coupon date is July 1, then according to this convention, the date difference is 180 days.

Actual/Actual: This convention calculates the difference between dates based on the actual dates, usually considering leap years. So, if the purchase date is January 1 and the next coupon date is July 1, then the date difference is 181 days (or 182 days in a leap year).

Bond Accrued Interest Calculation Formula

The accrued interest of a bond can be calculated using the following formula:

$$

AI = F \cdot \frac{C}{m} \cdot \frac{\text{Days from Last Coupon Payment to Settlement Date}}{\text{Total Days in a Coupon Period}}

$$

where:

AI = Accrued Interest

F = Face Value

C = Annual Coupon Rate

m = Number of Coupon Payments per Year

The derivation of this formula is as follows:

- The interest on a bond is usually determined by the annual coupon rate ( C ). The number of times the interest is paid in a year (m) affects the amount of interest paid each time, so the interest needs to be divided by the number of interest payments (m) to calculate the amount of each interest payment.

- Since investors who buy bonds between coupon dates only hold the bond for part of the period, the interest they should pay also needs to be calculated proportionally based on the holding period. That’s why the number of days from the last interest payment to the trade date (D) needs to be divided by the total number of days in one interest payment period (T) to calculate the accrued period.

Therefore, by combining the above factors, we can derive the formula for accrued interest.

For example, if a bond has a face value (F) of 1000, an annual interest rate ( C ) of 5%, pays interest twice a year (m=2), and an investor purchases this bond 75 days after the last interest payment, with a total of 180 days in one interest payment period (T). Then, we can substitute these values into the formula to calculate the accrued interest:

$$

AI = 1000 \cdot \frac{5\%}{2} \cdot \frac{75}{180} = 10.42

$$

Clean Price and Dirty Price

Definition

Clean Price: The quoted price of the bond, excluding accrued interest. This is the price usually quoted and traded in the financial market.

Dirty Price: Also known as the full price, is the total actual price of the bond, equal to the clean price plus accrued interest. This is the price that investors actually pay – but they will also receive the full interest payment on the next coupon date.

Formula

Dirty Price = Clean Price + Accrued Interest

Example

Suppose a bond with a face value of 1000, paying an annual interest of 5%, pays interest semi-annually and has a remaining maturity of 2.5 years. The market price (Clean Price) of this bond is 950.

An investor purchases this bond on a day between coupon dates, specifically 75 days after the last coupon date (out of a total of 180 days in the coupon period).

Therefore, the price that the investor actually needs to pay (Dirty Price) is: 950 (Clean Price) + 10.42 (Accrued Interest) = 960.42.